Summary

- Bitcoin currently valued at approximately $83,000, declining from $84,600.

- China announced 34% tariff on all U.S. imports.

- Ethereum trading around $1,841; XRP at $2.22.

- Dogecoin down 2.10%, now valued at $0.1755.

- Stock market futures dropped over 2%, indicating volatility.

- Investors reevaluating strategies amidst geopolitical shifts.

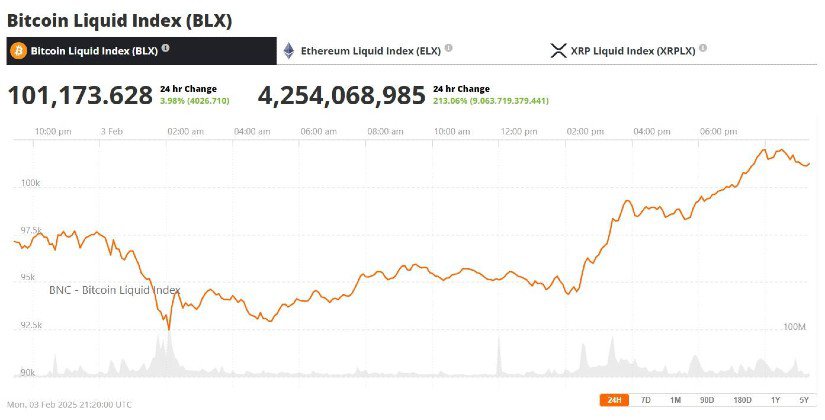

As of today, the cryptocurrency market is witnessing significant fluctuations, particularly in Bitcoin prices. Currently, Bitcoin stands at approximately $83,000, reflecting a notable decline from its recent peak of $84,600.

This downturn in value comes in the wake of China announcing a hefty 34% tariff on all goods imported from the United States. The ripple effects of this decision have quickly influenced several cryptocurrencies, causing major players like XRP, Solana (SOL), and Dogecoin (DOGE) to surrender their recent gains.

Developments on the global economic front have simultaneously impacted stock markets. Futures linked to the S&P 500 and Nasdaq have dropped over 2%, indicating increased market volatility.

Analysts suggest that the increased tariffs may not only dampen U.S. economic prospects but could also heighten global economic uncertainty. Investors in the crypto space are particularly sensitive to such geopolitical shifts, as these conditions can provoke rapid price adjustments.

The latest numbers show that Ethereum (ETH) is trading at around $1,841, while XRP sees a slight uptick at $2.22. Conversely, Solana is down approximately 1.5%, now valued at $145.85.

Dogecoin is struggling as well, decreased by 2.10% and valued at $0.1755. These shifts illustrate how external economic pressures can affect multiple facets of the cryptocurrency landscape.

Major competitors such as Binance Coin (BNB) and Cardano (ADA) are also experiencing minor declines, further highlighting the widespread market impact. Investors are closely monitoring technological and financial trends within this sector.

The cryptocurrency market has always been prone to rapid changes, often influenced by regulatory news or shifts in international relations. With China implementing these tariffs, many traders are reevaluating their strategies and perhaps leaning towards safer investments during this turbulent time.

The volatility of Bitcoin, and indeed the market as a whole, exemplifies how susceptible digital assets are to factors beyond their immediate control. As we look ahead, it remains crucial for investors to stay vigilant about the evolving economic landscape.

The potential for further tariff increases or similar legislative actions could lead to additional adjustments in cryptocurrency valuations. With these market realities setting the stage for ongoing fluctuations, the future of Bitcoin and its counterparts remains a topic of active discussion.

This latest episode serves as a stark reminder of the interconnectedness of global economies. The impact of political decisions on digital assets is profound, and traders must adapt quickly to maintain their positions.

Observers believe that the cryptocurrency market may continue to experience turbulence as it grapples with these economic challenges. For now, many are awaiting further clarity on both the tariffs and their long-term implications for global finance.